Fintech Software Development

Secure, compliant, and scalable financial technology solutions for banks, fintech startups, and financial services across Germany and the EU. We design and build high-performance platforms: payments, lending, scoring, KYC/AML workflows, internal financial systems, and data-driven decision tools — with architecture that passes security review and survives scale.

Built for Modern Fintech Teams

We work with companies that need more than a brochure site — they need real financial infrastructure.

Banks and financial institutions launching new digital products

Fintech startups building payment, lending, or investment platforms

Card issuers, PSPs, and payment orchestration platforms

BNPL, consumer lending, and B2B credit solutions

Scoring, risk, and underwriting teams that need reliable data pipelines

Wealth, brokerage, and investment platforms

Internal teams modernizing legacy core systems with modern APIs

Typical Challenges in Fintech Software Development

Most fintech products struggle not because of ideas, but because of architecture and execution.

Legacy core systems with no clean API layer

Manual processes around KYC, onboarding, and underwriting

Inconsistent data between CRM, core banking, and reporting systems

Fragile integrations with payment providers and card processors

No clear separation between business rules and infrastructure code

Limited observability into transactions, errors, and anomalies

Difficulty passing security audits and compliance checks

Systems that don't scale when transaction volume spikes

What We Build for Fintech Teams

We build backend systems for card payments, bank transfers, payouts, and internal wallets:

- •Transaction processing pipelines

- •Idempotent APIs and retry-safe workflows

- •Ledgering and balance management

- •Reconciliation flows and reporting exports

End-to-end flows for lending products:

- •Application and onboarding workflows

- •Scoring and risk rules engines

- •Offer generation and decisioning logic

- •Repayment schedules, penalties, and restructuring logic

We design data flows that your risk and analytics teams can trust:

- •Event-driven architectures for transaction and behavioral data

- •ETL/ELT pipelines into ClickHouse / BigQuery / PostgreSQL

- •Feature stores and scoring inputs for ML models

- •Dashboards for risk, collections, and product performance

We integrate KYC/AML providers and wrap them in clear workflows:

- •KYC verification flows (documents, checks, liveness)

- •Sanctions & PEP screening integrations

- •Suspicious activity monitoring hooks

- •Audit trails, logs, and case-management APIs

We expose your fintech capabilities through stable, secure APIs:

- •REST / GraphQL / gRPC APIs with clear versioning

- •OAuth2 / JWT / Keycloak-based access control

- •Rate limiting, throttling, and abuse protection

- •Partner onboarding flows and developer documentation

We build the internal interfaces your team actually uses:

- •Operator consoles for support and risk teams

- •Back-office tools for adjustments, refunds, overrides

- •Monitoring dashboards for transactions and incidents

- •Role-based access control for sensitive operations

How We Work With Fintech and Financial Services Teams

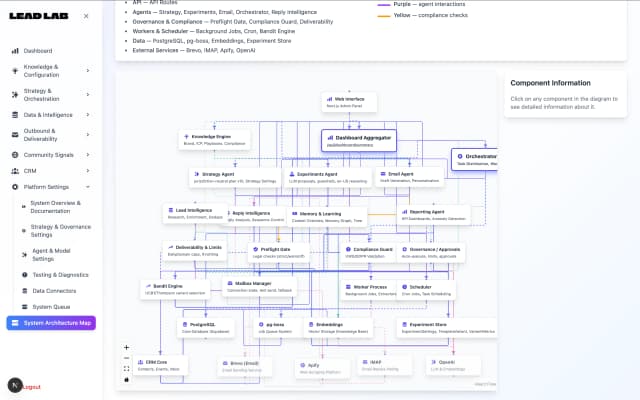

Architecture & Compliance Review

We review existing systems, integrations, and regulatory constraints (PCI-DSS, GDPR, internal policies). You get a clear architecture map and risk/tech debt overview.

Product & Data Design

We define domain models, transaction flows, data schemas, and integration points. Business rules are separated from infrastructure so they can evolve safely.

Implementation & Integration

We deliver backend services, APIs, data pipelines, and UI components. We integrate with providers (payments, KYC, scoring) and your existing core systems.

Hardening, Testing & Observability

Load tests, security checks, logging, metrics, and alerting. We ensure the system behaves predictably under real usage and is ready for incident response.

Launch, Handover & Iteration

We help you launch safely, train your team, and continue iterating based on data — not guesses.

Results we're

proud to show

What Fintech Teams Typically Achieve

Faster time-to-market for new financial products

→ From ideas to production-ready systems without endless rewrites.

Systems that pass internal security & compliance reviews

→ Clear architecture, auditable flows, access control, and logging.

Stable integrations with payment, KYC, and data providers

→ Fewer incidents, lower operational overhead, and predictable behavior.

Cleaner separation of business logic and infrastructure

→ Easier to change pricing, rules, scoring, or risk policies without breaking everything.

Better visibility into transactions, risk, and performance

→ Dashboards and monitoring designed for product, risk, and ops teams.

Architecture ready for growth and new markets

→ Multi-country, multi-currency, and multi-product expansion becomes a roadmap question — not a rewrite.

Frequently Asked

Questions

Yes. We regularly work with banks, licensed fintechs, and financial services operating under EU regulations. Our architectures are designed with GDPR, PCI-DSS, internal security policies, and audit requirements in mind.

Yes. Many of our projects involve modernizing or extending legacy systems rather than replacing them. We design clean API layers, integration boundaries, and migration paths that allow new products to coexist with existing cores.

No — but we design systems to support compliance. We do not replace legal or compliance teams. Instead, we build technical architectures that make compliance possible: audit trails, access control, logging, data separation, and traceable decision flows.

Security is built into the architecture from day one. We design systems with clear trust boundaries, least-privilege access, audit logs, and observability. We also support internal security reviews and penetration testing phases.

Related Services

Services that help deliver secure platforms and compliance-ready systems.

Related Industries

Other industries where we build platforms and automation.